Unlocking Startup Liquidity In Southeast Asia: IPO Remains Frozen, M&A Holds Steady

Availability of startup funding remains challenging, as venture investors demand both growth potential and a solid financial foundation. Beyond primary funding rounds (seed, Series A, etc.), some startups with more business traction have chosen to raise capital through IPOs (initial public offering) or to consider an M&A (merger/acquisition). While primary rounds provide initial growth capital, mature startups seek liquidity and returns. Besides capital, IPOs offer access to public investors and the option of a secondary raise. An M&A could create strategic partnerships, providing resources, technology, and market access for accelerated growth.

In a thriving IPO market, startups pursuing a public listing can stimulate M&A activity by setting valuations and offering companies flexibility. Many firms pursue both IPO and M&A to maximize investor returns. This competition between acquirers and public investors can drive higher valuations. IPOs also benchmark private company values, aiding M&A negotiations. Startups have more options: going public for capital and visibility or merging for synergies. An active IPO market fosters dynamic deal-making, benefiting both startups and investors.

IPOs and M&A are crucial components of the venture capital ecosystem. Successful exits through these channels enable venture capitalists (VCs) to monetize investments and return capital to limited partners (LPs). This liquidity empowers LPs to reinvest in new VC funds, funding innovative startups and perpetuating the venture capital cycle. A decline in IPO and M&A activity can disrupt this cycle, potentially slowing investments in new startups.

In Southeast Asia, primary funding remains stagnant and investment deals are taking a prolonged period of time to close. Bridge rounds have become a common stop-gap measure with investors working with startup management to trim operating expenses. However, these bridge rounds often provide less capital and shorter runways, making them less than ideal for long-term growth. Investors are generally reluctant to fund startups through bridge rounds repeatedly.

M&As as Catalyst for Inorganic Growth

Since 2006, Southeast Asia has witnessed a growing number of startup M&A transactions over the past years. According to TechinAsia, there have been more than 500 M&A transactions across Southeast Asia involving startups, with an average of 50 transactions over the last 5 years.

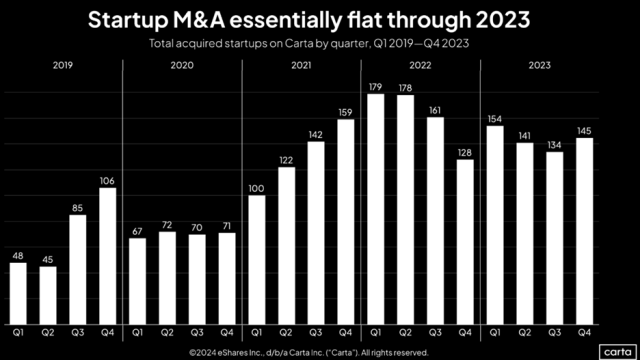

M&A in the startup sector continued at a steady pace in 2023, exceeding pre-pandemic levels. Carta highlighted a notable shift where a larger proportion of acquired startups were smaller companies with fewer than 10 employees. This marked the highest percentage of small-scale acquisitions in the past five years. In contrast, the number of larger deals involving companies with 100 or more employees reached a new low. This trend might indicate that smaller startups are increasingly viewing M&A as a viable exit strategy to secure their future.

Tech giants like Nvidia and Microsoft have built up substantial cash reserves and are actively on a roll-up play. Following the playbook of predecessors like Amazon, Apple, Facebook, and Google, these behemoths have grown their empires through hundreds of acquisitions over the years. Their strategy typically involves dominating their core business, such as e-commerce for Amazon or search for Google, and then expanding into new sectors through strategic acquisitions. This approach allows them to diversify revenue streams, out-manoeuvre competitors, and solidify their market position.

Recent M&A news includes Nvidia’s announced acquisition of Run:ai, a company specializing in GPU workload management. Nividia and Run:ai have been business partners since 2020 and the Nvidia acquisition could be a strategic move to solidify its position as a leader in the AI industry. In another high-profile deal, Google announced plans to buy Wiz, a prominent Israeli cybersecurity startup, for a record-breaking $23 billion. This is a very substantial acquisition and highlights Google’s commitment to its cloud and cybersecurity offerings. However, reports have indicated that Wiz chose to remain private and independent, opting to pursue an IPO instead.

In Southeast Asia and as far back in 2016, Google made its first strategic acquisition of a startup Pie, a Slack-like team communications service based in Singapore. Pie had a talented team of engineers, and Google likely saw the acquisition as an opportunity to jumpstart its first engineering team devoted to Southeast Asia. A couple of months back in July 2024, Singapore-based ride-hailing and delivery giant Grab Holdings acquired the popular restaurant reservation app Chope to add to its core services of ride-hailing and food delivery. This acquisition seems to align with Grab’s strategy to expand beyond its core services of ride-hailing and food delivery. By combining Chope’s restaurant reservations with Grab’s transportation and delivery services, Grab can offer a seamless user experience. This enables consumers to book a restaurant, take a ride to the venue, and enjoy a meal, all within the Grab app. Chope’s strong reputation in the region can help Grab extend its consumer services to the vast Southeast Asian market of over 650 million people.

Omnilytics, a Singapore-based fashion analytics provider, acquired Malaysian data labeling platform Supahands for $20 million. This strategic move aims to enhance Omnilytics’ Product Match solution, which helps brands and retailers compare product pricing across different platforms. Supahands’ expertise in data labeling will be instrumental in improving the accuracy and efficiency of Omnilytics’ product matching technology, providing clients with even more valuable insights into market trends and pricing strategies.

New York Stock Exchange-listed PropertyGuru (PGRU) expanded its services beyond property listings by acquiring Sendhelper, a home cleaning and maintenance provider. This acquisition allows users to find properties, get financing, and manage their homes all within one platform. In a surprise move, PropertyGuru agreed to a take-private deal with EQT Private Capital Asia, valuing the company at $1.1 billion. PropertyGuru agreed to a take-private deal with EQT Private Capital Asia, valuing the company at $1.1 billion. This merger brings together EQT’s expertise in technology and marketplaces with PropertyGuru’s online property platform, aiming to create a stronger and more comprehensive entity.

From Competitive Foes to Collaborative Partners via M&A

As the Southeast Asia venture and startup landscape matures, M&A can be seen as an inorganic growth to enter new markets, bolster customer base and product offerings while eliminating competitive frictions. These strategic mergers and acquisitions can help companies accelerate their growth, gain access to new technologies, and strengthen their market position.

UK-based data and analytics firm Ascential’s purchase of Singaporean e-commerce omnichannel solutions provider Intrepid for up to $250 million in upfront cash and deferred considerations is a prime example. Similarly, New York’s Fintech Payoneer’s acquisition of Singaporean global HR and payroll startup Skuad for $61 million underscores this trend. Both companies share a focus on serving small-to-medium-sized employers with distributed teams, offering international payroll and remote onboarding solutions.

The merger of Singaporean dating startups Lunch Actually and Paktor Group demonstrates the potential benefits of combining forces to expand market reach and deliver enhanced customer experiences. By leveraging their complementary online and offline services, the merged entity can offer more personalised one-on-one dating introductions.

A Straits Times report revealed that a significant portion of Southeast Asia’s used car trade remains offline, indicating substantial growth potential for online platforms. With an annual market value exceeding S$290 billion, this burgeoning industry has attracted the attention of unicorn companies seeking to capitalise on its opportunities. To solidify their market positions and expand their offerings, Southeast Asia’s automotive e-commerce leaders, Carro and Carsome, have embarked on an aggressive acquisition and investment strategy, focusing on platforms that provide complementary services within the used car ecosystem.

Carro has made several acquisitions or investments such as Beyond Cars (Hong Kong), MyTukar (Malaysia), MPMRent and Jualo (Indonesia) giving it access to 8 markets, including Singapore, Malaysia, Indonesia, Thailand, Hong Kong, Japan, and Taiwan. CarSome also made several strategic moves to acquire or invest into CarTimes Automobile (Singapore), WapCar and AutoFun, iCar Asia (Malaysia) and PT Universal Collection (Indonesia) giving the company access to new markets and interestingly into the generation of digital user content for the automotive industry.

While these examples highlight the potential advantages of mergers and acquisitions, it’s important to note that not all such endeavours result in success. Nasdaq-listed MoneyHero’s unsuccessful attempt to acquire MoneySmart underscores the challenges associated with such transactions. Both MoneyHero and MoneySmart are leading companies in the personal finance sector but appear to be on diverging paths in terms of strategy, financial sustainability, and outlook.

The Dilemma: To IPO or not to IPO

An IPO can be a strategic move for a tech company, offering several advantages. It provides access to a broader pool of investors, enabling companies to raise significant capital. This capital can be used to refinance existing debt, invest in growth initiatives, or reward employees and investors with liquidity options.

For matured tech companies like Plaid, Stripe, and Klarna who have filed and are lining up to go public, current market conditions do not seem to be optimal for listing. SPACs (Special Purpose Acquisition Companies) have been a popular route for tech startups to go public in recent years. However, the SPAC performance has been mixed, with few companies experiencing significant success while others have faced challenges. The SPAC route is technically not viable anymore.

There are many reasons why an IPO could be delayed and one of the key reasons could be the focus on topline growth and bottomline profitability. Singapore’s leading Fintech Nium has pushed back its plans for a US IPO till the end of 2026 in a bid to focus on growth and market expansion. Used car marketplace Carro is also positioning for growth and profitability while lining itself up for a public listing. According to a Citi report, the volume of IPOs this year is a fraction of the more than US$240 billion seen during the same period in 2021, before the Fed’s rate hikes. It’s also below the average seen in the decade before the pandemic.

Focusing on startups who have braved the public listing route, Southeast Asia startups such as MoneyHero (NASDAQ:MNY), Ohmyhome (NASDAQ:OMH), Ryde (NYSEAMERICAN: RYDE), Nuren Group (NSX:NRN), Bukalapak.com (IDX: BUKA) and many more have seen their share price dipped by as much as 80% since listing. A public listed company is subject to scrutiny and expectations from investors and the stock exchange. If the share prices continue their descent and stay below the exchange’s minimum price threshold for an extended period, these companies could face a potential delisting penalty.

The Funding Outlook for 2025

The venture capital landscape in 2025 stands at a crossroads of opportunity and caution. The US Federal Reserve’s strategic interest rate reduction, the first cut since 2020, has catalyzed renewed optimism, with investors keenly anticipating further cuts. While many venture capitalists see this as a potential renaissance for a previously tepid market, the implications extend beyond mere capital availability.

In an era of abundant capital, true differentiation lies not in securing funding, but in deploying it with strategic precision. While easier access to capital may tempt startups to accelerate growth aggressively, maintaining steadfast financial discipline remains paramount. By prioritizing sustainable expansion and implementing sound financial management practices, companies build a resilient foundation capable of weathering diverse economic conditions.

Beyond traditional venture equity, savvy startups are increasingly diversifying their funding strategies to reduce reliance on single capital sources. This comprehensive approach encompasses various financial instruments, from venture debt to working capital lines of credit, enabling both organic growth and strategic mergers and acquisitions. As the startup ecosystem evolves, companies are particularly leveraging debt financing to fuel M&A activities, forging partnerships with entities that share aligned goals and missions to drive meaningful expansion.