The Value of Venture Debt to Startups

Over the past two years, we have seen how the global pandemic adversely affected companies across a wide range of sectors from the implementation of lockdowns and travel restrictions, to an increase in the visibility and transparency of supply chains. Despite being a difficult year for numerous businesses, many startups, especially in the Southeast Asia region have powered through.

While the global pandemic will eventually recede, the impact of business decisions made during these pressing times will go a long way. Startups that raise capital and have a spare dime for rainy days like these will have an edge.

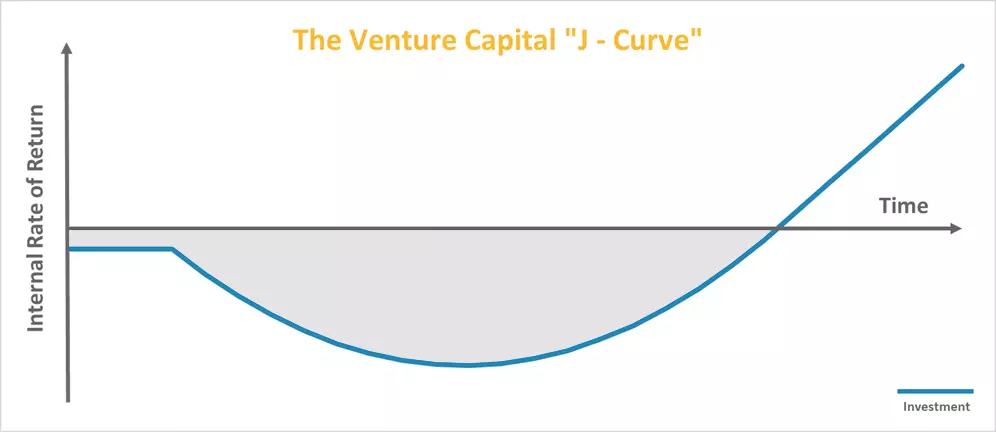

Cash Burn J-Curve

One of the most persistent challenges for startups is to sufficiently capitalize the business from the inception of the company until profitability. US startups have had the good fortune of leveraging on venture debt for several decades. Despite a very challenging Covid year in 2020, startups in the US received debt financing valued at more than $25 billion[1], the third consecutive year for the market to surpass $20 billion in venture loans.

Most startups traditionally utilize equity as their source of capital and go on to raise billions of dollars to fund the J-curve growth of their business. The J-curve is commonly used to illustrate the tendency of a startup company to produce negative net income initially, and then deliver accelerated positive results as the company matures. The negative net income area above the “J” represents the total cash needed to achieve profitability and the typical startup company will take at least six years before becoming profitable.

Source: https://pitchbook.com/news/reports/q1-2021-pitchbook-analyst-note-venture-debt-a-maturing-market-in-vc

Blend of Venture Equity and Debt Capital Markets

As venture debt has emerged in Southeast Asia, an increasing number of companies have deployed debt financing to complement equity rounds. To date, there are about 80 – 100 Southeast Asia companies that have already benefited from venture debt.

Genesis Alternative Ventures is a Singapore-based venture debt fund that invests debt capital into promising early-growth startups that are expanding their business presence across Southeast Asia. We will feature 2 Genesis portfolio companies – Horangi Cyber Security and GoWork and share their venture debt journeys.

Example 1. Horangi

Founded in 2016, Horangi is a cybersecurity company that provides security support for enterprises in Asia against cyberattacks through its suite of products and professional advisory services.

Venture debt became a useful, less-dilutive tool for Horangi as it enhanced its cloud security products, increased its talent pool and acquired customers through sales and marketing activities as part of their growth and expansion plans. “As a startup with a short operating history, it is almost impossible to get normal bank loans, which is where venture debt fills in the gap.” Horangi was also looking for partners who could add substantial value to their business and “partnering with strategic investors like Genesis will help propel our next growth stage,” said Paul Hadjy, CEO and Co-founder, Horangi.

“As Horangi scales its business, choosing a venture lender who is committed and understands the business is critical. It’s not only about access to capital, but also the flexibility and the invaluable network that Genesis brings along.” – Dr. Jeremy Loh, Managing Partner of Genesis Alternative Ventures.

Example 2: GoWork

Founded in 2016, GoWork is a leading premier co-working space operator in Indonesia.

“Co-working is not a category anymore, it’s just how people work. It’s a matter of time when every office building or mall in Jakarta will need a space.” For GoWork to double down on its focus on Jarkarta and reach over 100,000 sqm by 2020, the company took on venture debt to fund its working capital. “We wanted to have diversification in our capital structure without incurring dilution,” said Vanessa Hendriadi, CEO & Co-founder, GoWork.

Not only does venture debt help with working capital needs, but entrepreneurs are also seeking “more efficient capital and putting in place additional capital buffers”. – Martin Tang, Co-founder of Genesis Alternative Ventures.

Venture Debt Moving Forward

Venture debt offers an additional channel of financing for entrepreneurs who want to leverage debt financing to balance the cost of capital. Venture debt is set to play a bigger role as more startups are growing amid a global pandemic and are looking for ways to raise additional capital without significant dilution to their equity stakes.

To find out more about venture debt, access the Southeast Asia Venture Debt Industry Report 2021 co-authored by Genesis Alternative Ventures and PwC Singapore here.

[1] https://pitchbook.com/news/reports/q1-2021-pitchbook-analyst-note-venture-debt-a-maturing-market-in-vc