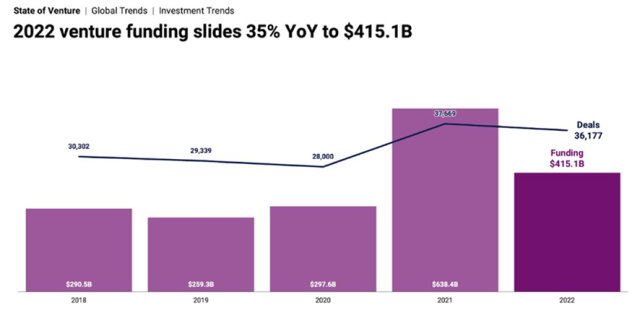

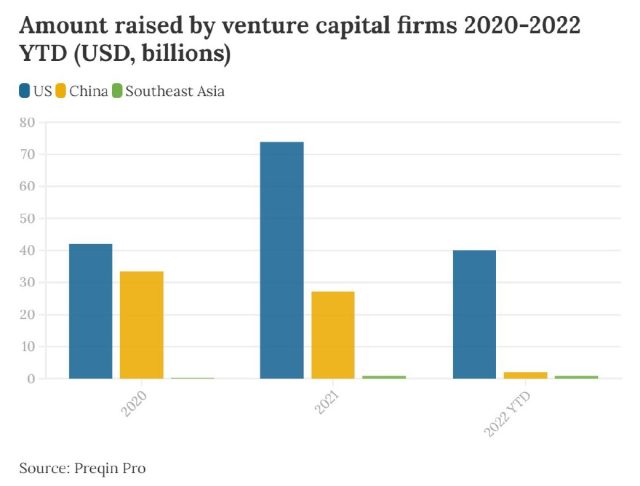

The equity winter is well underway and has impacted tech ecosystems globally. The catalysts behind this funding drought – rising interest rates, economic uncertainty, and a recalibration of valuations – are well-documented. While hopes for an imminent thaw remain, investors and start-ups have adapted to the new reality of longer and more difficult fundraising rounds with many companies choosing instead to cut costs, preserve cash, and raise bridge rounds from insiders until the equity market returns.

How has venture debt fared during this time? Have lenders been able to plug the gap or have they experienced similar trends? How did the collapse of venture lender behemoth Silicon Valley Bank (SVB) in March 2023 impact the lending ecosystem? Will venture lending developments in the United States (the undisputed market leader for venture lenders and borrowers) signal what’s round the corner for the Southeast Asia ecosystem?

We consider these questions and in parallel highlight key observations from Dr Jeremy Loh’s attendance at the second annual Venture Debt Conference held in March 2024 in New York (where Genesis participated in discussions and networking opportunities with the likes of prominent banks with venture lending businesses such as Silicon Valley Bank, a division of First Citizens Bank, HSBC, Deutsche Bank, Comerica and a spectrum of private debt funds ranging from dedicated venture debt funds like Runway Growth, Vistara Growth, Bootstrap Europe to private credit players such as Horizon Tech Finance.

Surprising Early Resilience Despite Headwinds

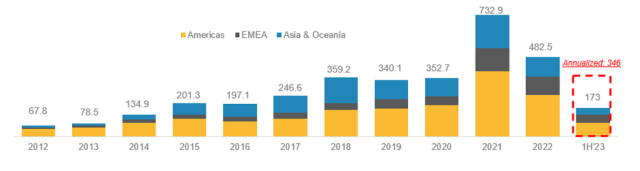

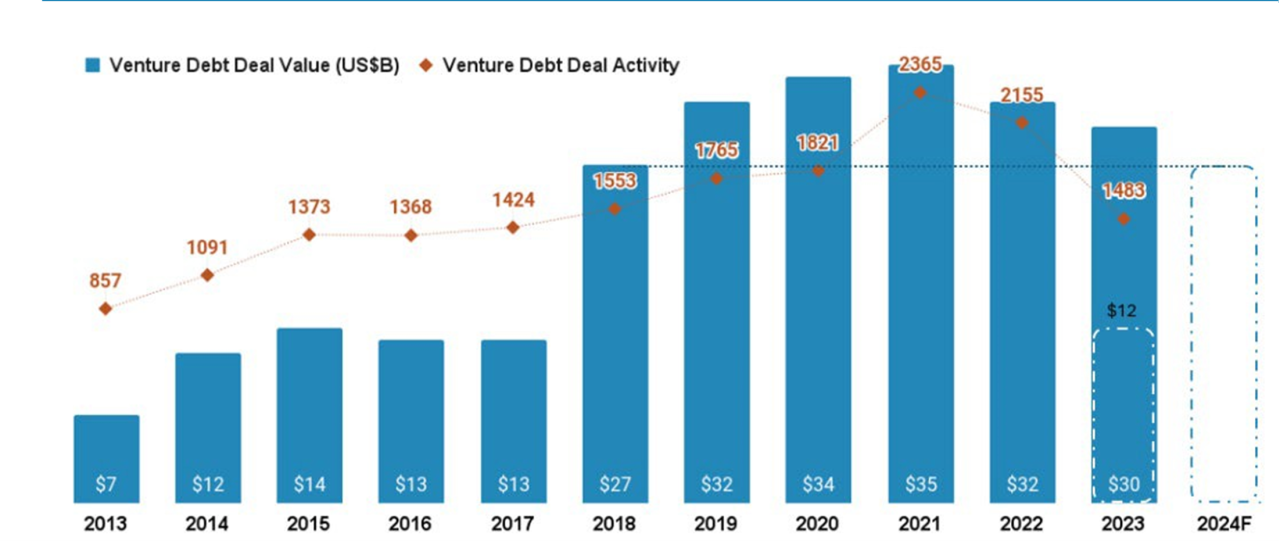

Market predictions following the SVB saga anticipated a significant decline in US venture debt financing for 2023. Forecasts suggested a potential drop exceeding 50%, ending a four-year streak of annual activity above $30 billion.

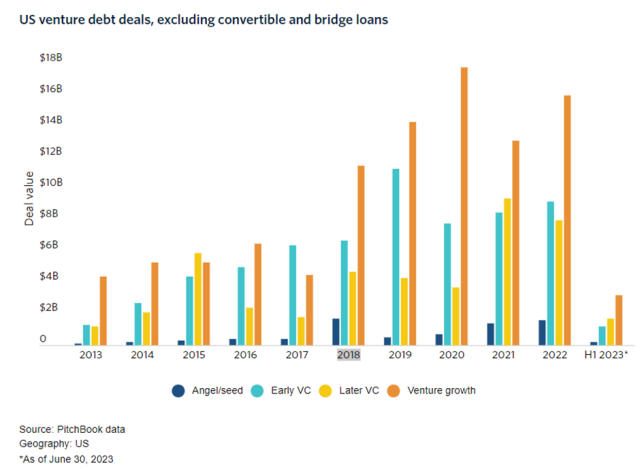

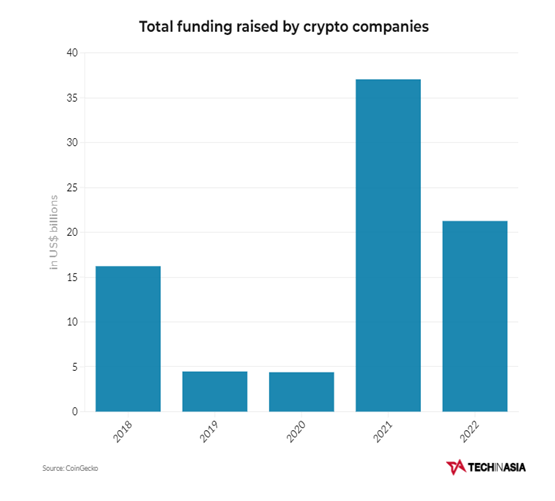

However, conference participants were bullish about venture debt pipeline opportunities. In fact, PitchBook data revealed a surprising resilience, with 2023 marking the fifth consecutive year surpassing the $30 billion threshold (Figure 1). Despite this positive development, a slowdown in capital availability within the venture sector is expected to impact 2024 figures. Estimates suggest a potential decline to a range of $14-16 billion but the outlier driving strong venture debt demand could push figures up to 2018 level of $27 billion.

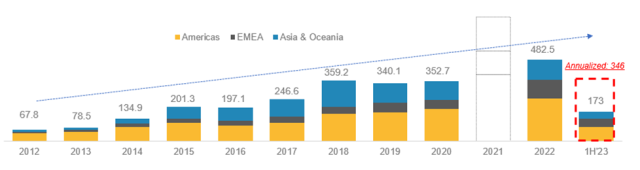

A deeper analysis of venture debt deal count by startup stage sheds light on the allocation of venture debt capital (Figure 2, next page). PitchBook data indicates that seed and early-stage companies have experienced the most significant decline in deal volume. This aligns with the fact that SVB, which previously held a 50% market share in early-stage bank venture debt, has seen its lending shrink to roughly 20%. Conversely, late-stage loan activity has seen resilience and exhibited minimal decline, with 2023 emerging as the second-most active year in terms of deal count. Interestingly, PitchBook believes that there will be a continuation of the overall trend, predicting that venture debt in the US will exceed $30 billion for a fifth consecutive year in 2024. This optimistic outlook stands in contrast to the prevailing market sentiment, and only time will tell if it materialises when the first-quarter data of 2025 becomes available.

New Normal For Venture Debt: Proven Performers Welcome, VC Backing No Guarantee

The current economic climate has left many startups’ balance sheets in a less than ideal state compared to just a couple years ago. This tough environment has prompted investors and lenders to offer founders advice that may differ from what they’re accustomed to hearing. The message from Conference participants was clear: take the capital you can get – even if it’s at a down round with a liquidation preference – if that’s the only way to keep fighting.

Major venture and growth debt lenders are signalling a notable shift in their priorities. They are now open to financing established businesses with proven revenue models, even if they haven’t secured a recent equity round. In contrast, companies with dated equity rounds, limited traction, and a failure to reduce cash burn are the least preferred borrowers.

The focus for lenders has shifted to evaluating a company’s fundamentals – strong products, revenue generation, and a clear plan to bridge their funding gap. Profitability is seen as a major plus. Interestingly, the prestigious pedigree of a startup’s venture backers (e.g. Sequoia, Khosla Ventures) now carries less weight. As one lender put it, the key question used to be “Who’s backing you?”, but now a solid business case and financial runway are paramount in addition.

This evolving funding landscape requires startups to adapt their approach and messaging to appeal to the new priorities of investors and lenders. Those that can demonstrate financial discipline, revenue traction, and a clear path to profitability will be best positioned to secure the capital they need to weather the current economic storm.

Partnering With The Right Lender

When it comes to securing venture debt financing, the choice of lending partner is a crucial decision for startups. Considering that 76% of venture debt loans require amendments throughout their lifetime, startups must focus on finding a lender who can truly work alongside them as a strategic partner for the best possible outcome.

Lenders that take a “full platform approach”, tracking not only the financial performance of its portfolio, but also the holistic relationship and overall support provided to each company and founder are ideal partners. This level of commitment and consultative approach is key for startups navigating the complexities of the venture ecosystem.

Lenders with deep relationships within the venture capital community are also an important factor when choosing a reliable debt provider. These lenders are often involved in the debt raise conversation, providing valuable insights and alignment with the startup’s investors. Startups must be fully aware of the debt terms, such as meeting cash runway covenants, and understand the reporting requirements and third-party items demanded by the lender. The management team (and their key equity stakeholders) must be well-versed in navigating the positive and negative covenants.

Building trust and confidence in the counterparty relationship is paramount. Startups should seek lenders with a proven track record of working through challenging cycles and decisions alongside stable management teams. Forging these relationships proactively, and picking the lender’s brain on debt structure, can give startups an advantage. Creativity and sophistication in negotiations can also help bridge gaps, as the terms of warrants and other financing events can vary. Thorough due diligence is key, as startups can expect longer and more involved processes when selecting a venture debt partner.

Here’s a summary of the key points discussed by Conference participants:

- Venture debt is more art than science – it’s crucial to find a lender that truly understands your business and the innovation economy;

- Look for lenders with the right “Four Cs”: Capital, Commitment, Consultative approach, and Consistency through economic cycles;

- Venture debt should be used judiciously, not as the sole source of runway – it needs to be part of a balanced financing strategy;

- Startups must perform extensive due diligence on potential lenders, not just the other way around;

- Venture debt can provide benefits like non-dilutive capital, runway extension, and acquisition/CAPEX funding – but the right lender partnership is key.

Navigating Venture Debt In A Challenging Funding Climate

As startups navigate the current funding landscape, the consideration of venture debt has become increasingly important. However, startups must approach this financing option with strategic foresight, balancing the benefits with the potential risks. In the current climate, the priority should be on securing access to capital and maintaining flexibility, rather than getting too caught up in the mathematical details.

One key factor to consider is the interest rate environment. While most lenders anticipate that interest rates will start to fall towards the mid-to-late 2024 timeframe, this could affect the repayment burden if rates are kept flat or for unforeseen circumstances begin to rise. This shifting rate landscape should factor into a startup’s decision-making process when evaluating venture debt.

Overleveraging debt can lead to negative outcomes, so startups must take the appropriate amount of leverage and have a clear repayment plan. Lenders view a “Hail Mary” situation as a red flag, so startups should aim to have a clear path to new equity or an M&A term sheet to make the venture debt more viable.

Companies seeking large debt raises may be a concerning signal, as it could suggest limited equity availability. Combining equity and debt can provide working capital and growth capital, but the management team must carefully consider and align with their board on the best approach.

Building strong borrower-lender relationships is crucial, looking beyond just interest rates. Startups should prioritize choosing lenders with specialized expertise in their industry and focus on cultivating a strong partnership, rather than solely optimizing for the lowest rate. Preparing quality financial statements in advance is also key, as lenders have become more sophisticated in their scrutiny. Startups should aim for audited financials, if feasible, to streamline the due diligence process and potentially facilitate deal-making.

In summary, navigating venture debt in the current funding climate requires startups to be strategic, discerning, and proactive. By carefully considering the trade-offs, building strong lender relationships, and ensuring financial readiness, startups can leverage venture debt to fuel their growth while mitigating risks.

Dealing with Distress: Lenders’ Approach to Troubled Startup Borrowers

When dealing with distressed startups that have raised venture debt, lenders must take a collaborative and pragmatic approach to achieve the best possible outcome. Despite any initial dissatisfaction, a successful workout requires all parties – lenders, management, and other stakeholders – to work together transparently and recognize the inherent value in the company’s assets.

Lenders should be proactive in identifying signs of financial distress, such as a startup’s failure to meet key milestones or its inability to raise fresh equity. When these issues arise, lenders should be upfront about their concerns and work collaboratively with the startup’s management to find a mutually agreeable financial solution that supports the company’s growth and path to cash flow positivity.

Employees and the management team are the primary stakeholders in a distressed startup scenario. Ensuring their motivation and satisfaction is crucial, as they are the ones who will ultimately drive the company’s turnaround efforts. Creditors must be willing to take a collaborative approach with management, even if it means accepting a less-than-ideal outcome for equity holders.

The concept of “management carve-outs” can be a useful tool in guiding distressed startups through this challenging period. In these situations, management teams may be unfamiliar with the complexities of insolvency and financial distress. Experienced general partners from the venture capital world can play a valuable role in helping management navigate these uncharted waters and align their actions with their fiduciary obligations to all stakeholders.

The emphasis is on having sponsors with strong track records and a proven ability to navigate these complex distress scenarios effectively. A single sponsor may be more efficient and have a distinct risk perspective, while a syndicate may face greater challenges in reaching consensus, potentially carrying slightly more risk.

While lenders must adopt a cooperative and pragmatic mindset, the key outcome is to maximize recovery. By prioritizing the needs of key stakeholders, leveraging management carve-outs, and maintaining transparent communication, lenders can increase the chances of a successful turnaround and maximize the value of the company’s assets

The Golden Age Of Credit: The Landscape Of Venture Debt And Bank Capital

Private credit as a broad asset class continues to attract significant fundraising dollars, with the venture debt category following suit and resulting in an ever-growing lending landscape. In recent years, there has been a notable compression in the cost of capital across various types of lending, including traditional bank facilities and venture debt. The increase in overall interest rates has led to a narrower pricing spread between these financing options, making bank capital more competitive in the current environment.

The emergence of larger, traditional investors exploring venture debt as an asset class has further validated its importance. For example, BlackRock’s acquisition of Kreos Capital, a European venture debt platform, highlights the growing prominence of this financing avenue. Kreos Capital has invested more than €5.2 billion through nearly 750 transactions across 19 countries since 1998. Another notable acquisition is Monroe Capital’s purchase of Horizon Technology Finance (NASDAQ: HRZN), a non-banking leading specialty finance company that provides venture debt financing. Monroe Capital, a $18.4 billion private credit firm with a 20-year track record in direct lending, has directly originated and invested more than $3 billion in venture loans to over 315 growing companies. These high-profile acquisitions by major players like BlackRock and Monroe Capital underscore the increasing significance of the venture debt market. The influx of larger, traditional investors validates venture debt as an attractive asset class, ushering in a “golden age” of credit with favorable conditions for investors.

In the aftermath of SVB’s collapse, major global banks have been jockeying to position themselves as the new preferred lender for startups globally. Institutions like JPMorgan Chase, HSBC, and Deutsche Bank have all made concerted efforts to capture this lucrative market. JPMorgan, for example, has been actively expanding its venture banking division, seeking to leverage its deep pockets and extensive resources to attract startups. The bank has touted its ability to provide comprehensive financial services, from lending to treasury management, to cater to the unique needs of high-growth companies. This trend has been driven by the increased capital formation within the venture capital community, allowing companies to stay private and grow for longer. As this trend reversed, leading to greater need of venture debt, traditional lenders have improved their underwriting capabilities to facilitate larger transactions.

Mature venture debt markets, such as the US and Europe, have demonstrated that both private venture debt funds and venture debt banks can coexist harmoniously. This provides startups with access to different lender profiles, allowing them to choose the most suitable option – a private lender with more flexibility in their lending criteria or established venture banks that provide tailored banking solutions. The coexistence of private venture debt funds and venture debt banks has proven to be beneficial for startups, as it provides them with a diverse range of financing options to support their growth and expansion plans.

In the burgeoning venture debt markets of North Asia, excluding China and India, Japanese banks have been actively establishing a foothold to lend to Japanese startups. Major players such as MUFG, Mizuho Bank, Aozora Bank, and Tokyo Star Bank have been aggressively pursuing opportunities in this space, recognizing the growth potential of the local thriving startup ecosystem. Over in South and Southeast Asia, HSBC recently announced the launch of a $1 billion ASEAN growth fund and a $150 million venture debt fund dedicated to the Singapore market. This followed two other $100 million HSBC single market venture debt vehicles – a MYR$500 (~US$104) million fund for Malaysia, and AUD$227 (~US$147) million fund for Australia.

Venture Debt In Southeast Asia: Fueling Growth, Mitigating Risk, Embracing Sophistication

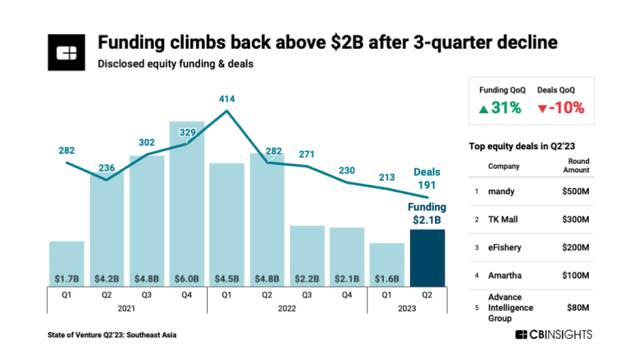

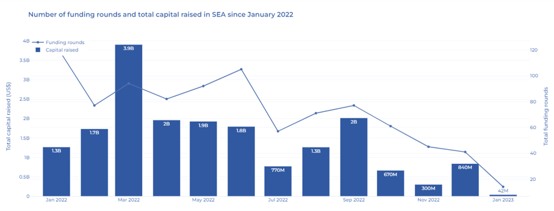

The venture debt landscape in Southeast Asia is undergoing a transformative phase, driven by several key factors regionally and globally. Firstly, the region is witnessing a surging demand for alternative financing options, fueled by the burgeoning startup ecosystem and the need for capital to fuel growth. This growing demand has attracted competition from traditional banks and specialized venture debt providers, giving rise to co-lending opportunities, enabling lenders to collaborate and share risk.

These factors are collectively shaping the trajectory of venture debt as an alternative financing option in Southeast Asia’s burgeoning startup ecosystem. Private lenders, such as Genesis Alternative Ventures, are well-positioned to capitalize on this evolving landscape. As startups adapt to challenging market conditions and prioritize profitability, private lenders can continue to grow alongside the ecosystem, deploying debt financing to support lean, efficient, and profitable ventures.

The venture debt landscape in Southeast Asia is dynamic and rapidly evolving, presenting both opportunities and challenges for lenders and borrowers alike. Those who can navigate this landscape adeptly, balancing risk and opportunity while embracing sophistication and collaboration, will be poised to thrive in this exciting and promising market.

References:

- Early-stage startups seeking venture debt find investor prestige isn’t enough

- Q4 2023 Public BDC Venture Lender Earnings

- Spring thaws venture debt market, but not everyone is feeling the warmth

- One year after SVB, the throne sits empty

- Life after debt: Venture debt funding could grow again in 2024

- B Capital’s M&A adviser expects startup-to-startup M&A to heat up