Grab-and-Go Coffee Brewing Up Success in Southeast Asia

Coffee is big business. With a market size estimated at $461.25 billion in 2022 and projected to expand at a CAGR of 5.2% from 2023 to 2030, it’s clear that coffee consumption is on the rise. The coffee market in Southeast Asia is projected to grow by 3.92% annually from 2024 to 2029, resulting in a market volume of

$10.3 billion in 2029. This growth reflects the region’s vibrant coffee scene, with consumers seeking unique experiences and emphasising sustainability and ethical sourcing.

Direct-to-consumer (DTC) brands are companies that generally bypass traditional retail channels to sell and market their products directly to consumers, typically through online platforms. The big idea is that this approach allows brands to have greater control over their marketing, customer experience, and pricing. The rise of e-commerce and digital marketing has fueled the growth of DTC brands, making it easier for startups and established companies alike to reach target audiences directly.

More and more, DTC brands have pursued an omnichannel approach in order to lay the foundations of sustainable business models. Many of the first movers in this space (think Warby Parker, Casper, Glossier etc) have already successfully integrated both off and online models.

Nowhere more clearly do we observe this trend than in the coffee space. Grab and go (GAG) coffee chains embrace a digital-first strategy to differentiate itself from traditional F&B businesses. The “New Retail” concept was put forward by Alibaba’s Jack Ma in 2016, which enables a seamless engagement between the online and offline world through data technology. A typical GAG coffee outlet has just enough space for the baristas to operate. There are limited seats (if any) and bare interiors. Smaller stores translate to lower rent and fewer employees. This significantly reduces each store’s operational costs, allowing chains to offer lower prices while maintaining a healthy margin. This leaner model also allows chains to expand more quickly. Customers can place their orders through the mobile app for pick up at their preferred outlet or delivery to their doorstep.

Coffee In Asia & Southeast Asia

Asia has already witnessed the emergence of a key pan-Asian home-grown coffee player – Jollibee Foods (JFC.PS) the region’s largest fast-food chain. Jollibee diversified into the coffee business through a series of acquisitions. Notably, in July 2024, Jollibee acquired a 70% stake in privately held South Korea’s Compose Coffee for $238 million. This followed their earlier acquisition of The Coffee Bean & Tea Leaf (CBTL) in 2019 for $350 million and a controlling stake in Vietnamese coffee chain Highlands Coffee in 2017.

Over the past five to seven years, the coffee landscape in Southeast Asia has undergone a remarkable transformation often with a strong flavour of technology (no double entendre intended) – download an app, get a first order at under $1 and receive your caffeine drink in 2 mins. Traditional coffee shops, boutique cafes and tech-savvy chains have sprouted up across the region, creating a vibrant and competitive market. From global giants like Starbucks and CBTL to homegrown unicorns like China’s Luckin and Indonesia’s Kopi Kenangan, coffee brands are vying for their share of the Southeast Asia market and consumer taste buds.

Asia’s coffee consumption has grown by 1.5% in the past five years, compared to 0.5% growth in Europe and 1.2% in the U.S, according to the International Coffee Organization, turning the region into the coffee world’s soon-to-be center of gravity. Traditionally a tea-drinking region, Asia’s growing coffee consumption is largely driven by the rise of a middle class that is keen to try anything trendy.

Deeply rooted in their colonial past, coffee cultures and export prowess define Southeast Asian coffee scenes. Vietnam’s French influence and Indonesia’s Dutch heritage are evident in their brewing traditions. Both countries remain in the top five global coffee producers (Figure 1).

Mobile Platforms Shake Up The Market And Challenge Established Coffee Brands

Fueled by a burgeoning middle class with rising disposable income and a growing appreciation for specialty coffee, Southeast Asia is experiencing a coffee revolution of its own. This trend has given rise to a wave of innovative coffee startups that are disrupting the traditional market landscape.

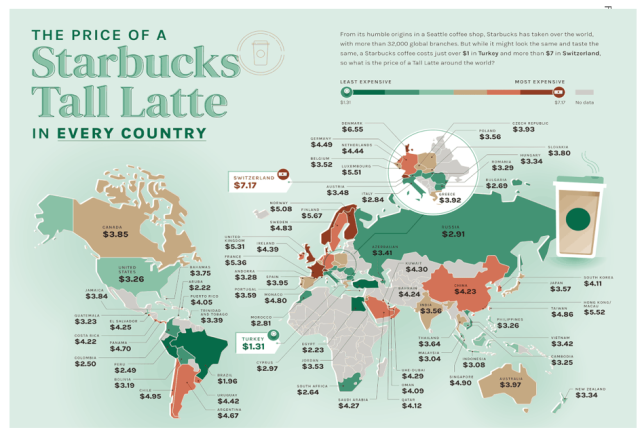

Price and unique flavour profiles are key drivers for many Southeast Asian entrepreneurs venturing into the coffee industry. Consider Starbucks’ pricing: a tall latte costs an American just 2% of their daily median income, but in Indonesia, that same drink can consume a staggering 30% of a local’s daily income (Figure 2). This vast disparity highlights the opportunity for homegrown coffee startups to cater to local tastes and offer competitive pricing model.

While GAG chains thrive on digital efficiency and affordability, established brands like Starbucks are looking to bridge the gap with their own digital initiatives, recognizing the changing consumer landscape. Starbucks wants to be a welcoming space between home and work and hence, customer experience within the physical store is paramount. However, they also recognise the growing importance of digital integration.

In China, for example, Starbucks partnered with Alibaba to bridge the gap with competitors like Luckin Coffee. Through this collaboration, they leveraged Hema, Alibaba’s supermarket chain, to expand their delivery radius through “Star Kitchens” located within Hema stores. Following this success, Starbucks expanded its pre-order and in-store pickup options beyond its own app, integrating it with four Alibaba platforms like Alipay. This year, they further embraced the digital landscape by signing a regional partnership with Grab to enhance their reach within Southeast Asia

Kopi Kenangan, also known as Kenangan Coffee, has over 800 outlets and monthly sales of millions of cups. Their success hinges on a meticulously-crafted pricing strategy. Take the “Kopi Kenangan Mantan,” their signature iced latte with palm sugar, for example. At only Rp24,000 ($1.50), it is a steal compared to international chains. By offering locally crafted drinks significantly cheaper than Starbucks, they have tapped into a lucrative market gap without sacrificing profitability. This winning formula lies in an innovative retail concept: a seamless blend of small, convenient offline stores with robust online ordering services. This technology-first approach allows them to reduce operating costs and maximize profits for continued affordability. They are not alone in this game – companies like Jago Coffee and Sejuta Jiwa are all brewing up delicious and affordable options for the growing Indonesian market.

A Shot At Brewing Up Billions

VCs are bullish on the Southeast Asian coffee scene pouring significant funds into this burgeoning sector. The region’s consumer-focused startups grabbed the largest share of venture capital deal value last year, replacing software as the hottest investment destination. According to PitchBook’s 2024 Southeast Asia Private Capital Breakdown, $4.2 billion was invested in Southeast Asian B2C startups in 2023, a 31.3% increase from the previous year. It’s worth noting that this growth stands out – coffee was one of the few sectors to see a rise in deal value in 2023, and it represented a significant 36.5% of the total deal value for the region, its highest percentage since 2020.

This surge in VC interest translates directly to developments in the Southeast Asian coffee landscape. Coffee-related startups are a major driver of the D2C boom, offering innovative and convenient coffee experiences for a growing and discerning consumer base. Let’s explore some specific examples across the region:

- Established Players with Big Brews: Indonesia boasts established coffee giants like Kopi Kenangan which has secured over $240 million in funding and achieved coveted unicorn status. Fore Coffee, another Indonesian player, is also a major player, having raised more than $40 million to date and offering a specialty coffee experience.

- Emerging Players Brewing Innovation: New startups are brewing up excitement with innovative concepts. Malaysia’s Koppiku has secured $2.5 million, while Vietnamese tech-enabled coffee chain Révi Coffee & Tea, highlighting the growing appeal of Vietnamese coffee brands. founded by former Gojek executives, is making waves. Additionally, ZUS Coffee in Malaysia is reportedly preparing for a significant $53.5 million investment round. The Philippines with Grab-and-go Pickup Coffee raised $40 million and seeking to expand internationally into Mexico’s value-focused coffee market with an outlet in the Polanco neighbourhood of Mexico City.

- Sustainable Solutions Sipping Success: VCs aren’t just focused on established models. Singapore’s Prefer, a startup offering bean-free coffee capsules for a more sustainable future, has secured $2 million in seed funding. This investment shows that VCs are looking beyond traditional models and towards innovative solutions that cater to the growing sustainability consciousness of consumers.

The surge in VC investment in Southeast Asian coffee startups translates to a plethora of choices for consumers. From established giants offering familiar comfort to innovative newcomers shaking things up, and sustainability-focused solutions for the eco-conscious, there’s something brewing for everyone. This fierce competition can be seen as a positive force, driving down prices and pushing boundaries in terms of service and product offerings. While some brands like Flash Coffee may not survive the intense competition, the survivors will be those that best adapt to consumer preferences and market dynamics.