Co-Working Post Covid-19

The Co-Working Story Pre-COVID

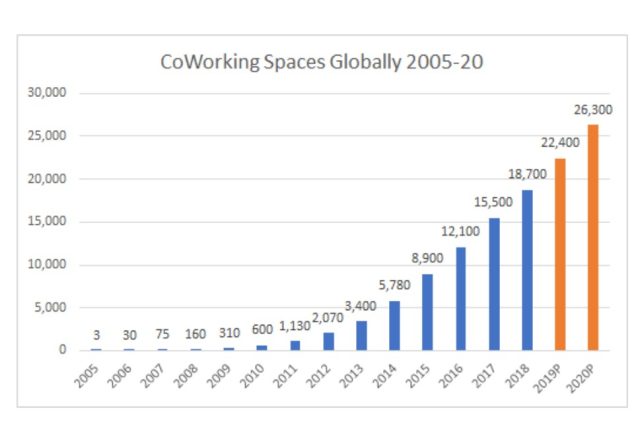

Looking at pre-COVID statistics of the co-working sector is important in understanding its growth potential post-COVID. In a research report published in September 2019, Colliers International shared that flexible workspaces, comprising co-working spaces and serviced offices, had risen in prominence in recent years to become a mainstream real estate asset class globally. The number of co-working spaces globally had grown by a staggering compound annual growth rate of 121% between 2005 and 2018.

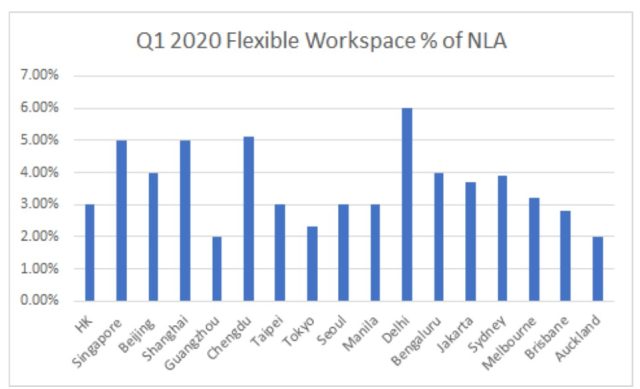

In Asia, as of Q1 2020, flexible workspaces had already accounted for more than 3% of net lettable area (NLA) in most markets compared to less than 2% in 2017.

Singapore represented the most mature co-working market in SE Asia. Singapore’s flexible workspaces accounted for 3.7 million sq ft of NLA of commercial space island-wide in 2018 – more than treble the 1.2 million sq ft available in 2015.

The Lockdown Begins

COVID-driven lockdowns started the world’s biggest work-from-home (WFH) experiment in early 2020. Armed with WiFi and a computer, the majority of office workers took to WFH with ease. It was clear that WFH offered a credible option – no time wasted commuting, increased productivity, no need to secure the large office long-term lease with high rental component. At the time, it was fair to also question the continued relevance of co-working spaces given WFH arrangements and social distancing.

Genesis’ portfolio company GoWork, Indonesia’s premier co-working space operator, had just turned EBITDA positive in December 2019. Expansion plans had to be frozen and the company acted swiftly to refine its operating SOP in order to cope with the new normal. Go-Rework (the parent company of GoWork) adapted quickly to mandated occupancy reduction, customers’ calls for split operations, social distancing, health checks etc. Taking a long-term view of the market, Go-Rework doubled efforts to sign-up enterprise clients that now required decentralized office spaces, and further leveraged their multilocation footprint in Jakarta allowing enterprises to split their teams across various GoWork locations for business continuity planning (BCP) purposes.

Key Observations Of Co-Working Spaces Globally During Covid

- Demand from corporates is the biggest expansion driver – co-working is now a business solution, not just a real estate alternative.

- Property developers are making co-working spaces a staple: for real estate owners, the presence of a co-working space in an office building or retail mall with 200-300 members has plenty of positive knock-on effects for retail and F&B in the same location.

- Corporates increasingly use co-working spaces to house innovation teams. A deliberate strategy to locate innovation teams in a startup-like environment to promote independence and decentralised thinking.

- Southeast Asia is a key battleground for dominance amongst operators with consolidation gaining momentum

- Scale is important. Go-Rework itself, is the product of a merger between GoWork and ReWork in 2018. It is now the lead premium co-working space operator in Indonesia.

Looking ahead to 2021

Surveys have shown that extended WFH is not sustainable. A majority of employees (and employers) prefer a conducive office environment as it allows for greater focus and productivity, team collaboration, and human connection. In fact, Go-Rework has already reported a rebound to pre-COVID demand and revenues. Thus, while COVID has slowed the growth of co-working in the early phases of the pandemic, it has since proven to be a silver lining. It is expected that co-working spaces will play a key role as the traditional office model continues to get disrupted.

For the foreseeable future, corporates are expected to operate on a hybrid WFH /WFO model and co-working spaces are expected to be central to this evolution.

Source: JLL Human Performance Survey, May 2020