What a difference these past two years have made!

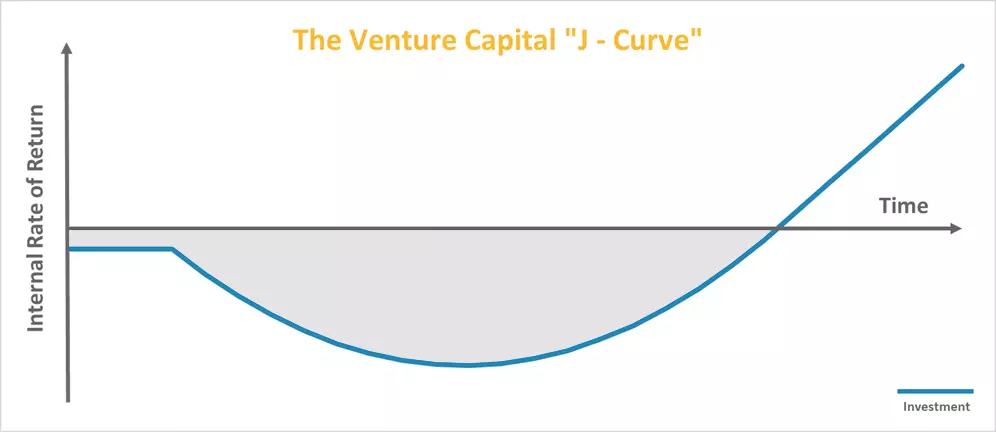

Whenever I was invited to speak about venture debt in the past, I always start by explaining to the audience that venture debt is a form of business financing that is tailored for venture-backed, high-growth startups who do not have the collaterals nor track record generally required by traditional banks. When used appropriately, venture debt is an attractive form of growth funding because it minimizes dilution of a founder’s (& early investors’) ownership stake.

Fast forward to February 2022 where I addressed a virtual room of startup entrepreneurs from SEA Founders – a community of growth-stage founders in Southeast Asia. I was very heartened by the sophisticated level of understanding about financing tools to power startup growth. Comparing this to when I first started out in venture debt in 2015, these founders have certainly become more acquainted with its use case.

However, I thought it would be useful to clarify some terminology and practices. This will be a handy guide for founders when talking to venture lenders as part of their next fund raise:

Convertible debt is not venture debt.

Venture debt is a bit like a mortgage loan. If we want to buy a house, the bank will provide us with a mortgage loan that we progressively pay down. Before we accept the loan, we would do our maths, asking ourselves, “how much do we have to pay on a monthly basis for this home loan? What are we comfortable with?” Once we decide, we don’t think about it much until the home bank loan is fully repaid. Once fully repaid, the house is ours.

On the other hand, convertible debt is where we borrow money to buy a house, but the lender has the option to decide if he wants the loan repaid in cash or take a portion of the house in return. Here the borrower has to deal with the uncertainty of whether a part of the house may eventually belong to someone else. Hence, a convertible debt is not venture debt.

Shares are not given free to lenders via warrants.

Due to the risk profile of a startup company, venture lenders will ask for warrants, which is an option to buy some shares in the company in the future at an agreed price. I think it’s important to understand that you’re not giving the equity warrants to the lender for free. The lender actually needs to pay and convert the option into shares of the company at a cost.

The way we describe it at Genesis is that we are investing debt into the portfolio company while simultaneously playing the role of small-time equity investor. Because we believe in your company, we’re willing to provide debt financing to grow the company. And because we have done our homework as an investor, we would love to be able to put some equity to play too.

Covenants can be used for instilling financial discipline

Many founders’ initial reaction to covenants is generally negative. However, I believe if designed reasonably, it can bring financial discipline and performance milestones for startups.

Early-stage start-ups tend to have big dreams. Founders would say to me “I am aiming for five million revenue this year and twenty million next year. Based on P&L. I think I am comfortable with a debt to equity ratio of forty percent, so I want to borrow five million dollars in venture debt.” But when we propose business and financial covenants around the loan, founders would come back and revise their projections e.g., “I can’t grow 4x within 12 months.”

A very canny CFO from one of our portfolio companies once shared that taking on venture debt has allowed him to introduce financial discipline within his startup. An example would be working out the mortgage repayment I described earlier and discipline is needed to make repayments on time. Having a venture lender onboard gives him the confidence that he has passed the stringent credit litmus test and he can confidently tell prospective VCs that he has a track record of being financially disciplined. Therefore covenants that are structured reasonably will help companies grow, rather than suffocate. Hence it would be useful to have a candid conversation with your venture debt lender on the purpose of the proposed covenants.

I hope the above “advanced level” clarifications about venture debt is useful for you. For an elementary overview of venture debt, please read this article on the “Top 10 Questions Every Founder Asks About Venture Debt.” If you have any questions on how venture debt can support your startup’s growth, please do not hesitate to contact me.

(A version of this article first appeared on LinkedIn on 28 February 2022.)